Going Grey: How excessive regulation is casting a dangerous shadow over European markets

Published first on https://egr.global/marketing/insight/market-watch-how-excessive-regulation-is-casting-a-dangerous-shadow-over-european-markets/

There is a fascinating meta narrative unfolding with health authorities in the UK and Sweden that bears a striking resemblance to the obstinate attitudes of their respective gambling councils. Until recently, such countries have been defiant in ‘going it alone’ on their Covid-19 tracing solutions, claiming their apps work better than Google and Apple’s unified API.

Unsurprisingly, the app trials tell a different story. Whilst the joint Google-Apple framework (for the first time) was adopted by at least 30 different nations, the Swedish offering was met upon launch with significant criticism due to privacy concerns. The UK app didn’t even make it that far; it was binned less than a month after a supposed soft launch. This is not the first time that legislation has tried to own tech on its own terms and failed.

But this is not just a story about abject incompetence – though that does play a significant part. This is a story about legislative obstinacy – the reluctance of policy makers to listen to the smarter voices in the room saying that trying to take on tech at their own game is pointless and will end up costing immeasurable time, cost (and lives) under delusions of grandeur.

Sound familiar? This is what’s currently playing out in most of the gambling northern hemisphere, with Sweden and the UK the frontrunners in a race to the bottom with both countries destined to out-do each other over who implements the most backward-facing policies. In a particularly foolish move, Sweden has just ignored the efforts of a (well-put together, given the time constraints) representative lobby consisting of the most senior gaming stakeholders, and instead insisted on implementing new restrictions from July 2nd without as much of a consultative peep from the industry. From this date forward, there will be a SEK5,000 (£428) deposit limit for online casinos until the end of the year, alongside a bonus cap of SEK100 (£9) on online casino. Not to mention additional time limits between spins.

Let’s be clear. There was always going to be a need for tighter regulative processes, especially around casino. Some of the whimsical protective measures that supposedly existed to protect players (and operators) that were still in force until recently (such as deferred KYC, unrestricted free-to-play for example) were long past their shelf-life. But lumping so many changes together only serves one clear purpose – to drive players to dark markets.

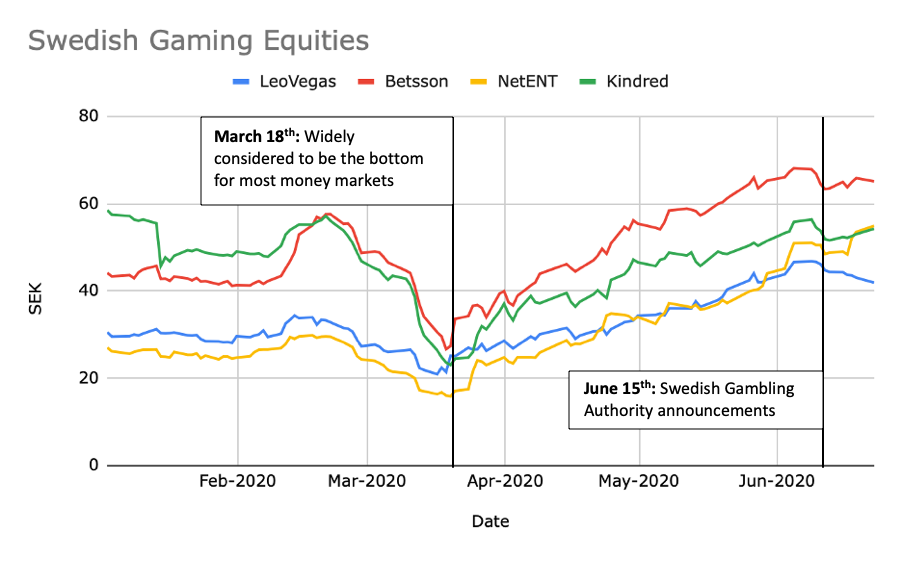

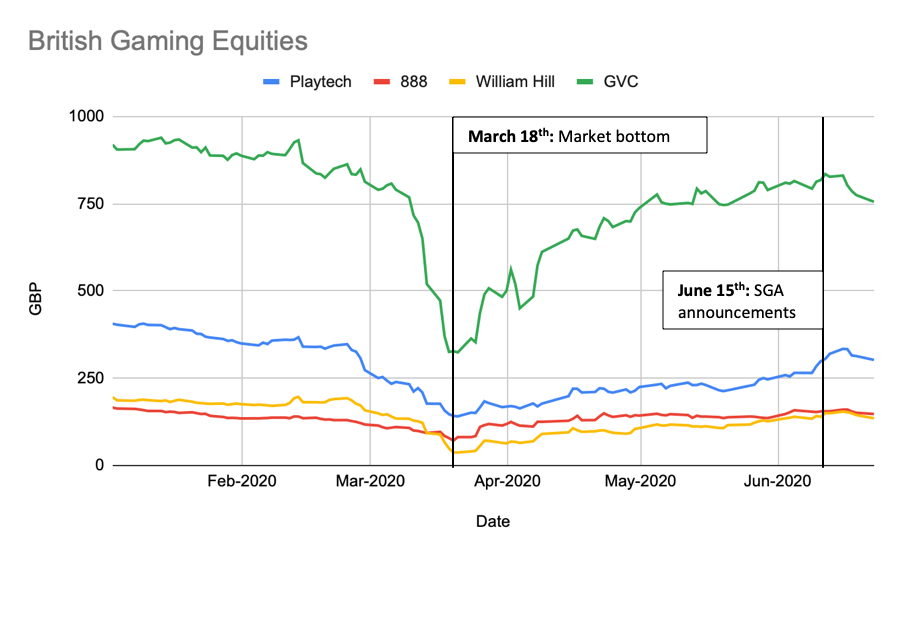

So, how will all this play out in the medium term? Is this just a flash in the pan or the start of the new normal? As with most macro-events, the best deterministic methods usually transpire from the wisdom of crowds, in this case, the stock markets.

A similar trend appears to be playing out for UK-listed equities holding Swedish licences. Granted, news is still fresh (at time of writing) so this is still a developing story. However, it’s safe to say that investors don’t seem to be particularly bullish about the short-medium term prospects in Sweden, or by extension, the UK.

What happens next will be what usually plays out when legislation tries to push a tech-centric industry into a specific direction. It will backfire, and particularly in Sweden’s case, spectacularly so. Online gamblers have always been spoilt for choice when it comes to content and have enjoyed engaging content from a plethora of platform providers. Generally, they tend to be technically proficient as well; that is newspeak for being able to use a decent VPN to get out of any bothersome cul-de-sacs. And if there’s any doubt about the likelihood of this, look at the direction of stock prices for some other global gambling companies who do not have the majority of their chips in either the UK or Sweden.

There’s a wider angle to all of this. There are other developing stories based on similar pretexts, but with far reaching consequences. For example, it’s also becoming increasingly harder to manage payments in Europe. This is partly because of legislation but also because of payment providers themselves. Look at what’s happening to Germany. The recent Wirecard fraud debacle will have ramifications that will go far beyond this year. Other PSPs such as Trustly have already smelt blood and pushed up their prices for a good portion of their customers. Conversion rates of 7995-based credit cards are at an all-time low. Whichever lens this is viewed under, it’s clear that operators, platforms, and players are very quickly running out of (legal) options.

In other words, after a relatively benign period, it’s now highly likely that Europe will once again go grey. Whereas previously this happened due to lax or no regulatory framework, this time round there has been excessive legislative and commercial throttling. And history shows that whenever this is done to a tech-savvy market, the new rules will be written by the rule breakers themselves…